Week Ahead 5-3-2010

admin on 05 3, 2010

What a crazy couple of days we had last week. Criminal investigations in Goldman and downgrades on Greece and Portugal were the big headlines. This weekend the European Union and the IMF agree to help the debt strapped Greece. I have seen varying numbers to the package, ranging from $95 to $140Billion.  To the US, that is chump change. That is a rounding error. To Greece though it means changing the way of life dramatically. The Greek citizens have lived beyond their means for too long.

Some of the austerity measures that Greece has to comply with are:

- An increase in the retirement age from an average age of 53 to 67

- Government workers to lose annual bonuses worth an extra two months’ pay

- Ten per cent tax rise on alcohol, cigarettes and petrol

- Three-year wage freeze in the public sector

- Early retirement will be limited or abolished altogether

- VAT increase from 21 per cent to 23 per cent.

- Public pension reduction of pension to average lifetime salary vs final salary

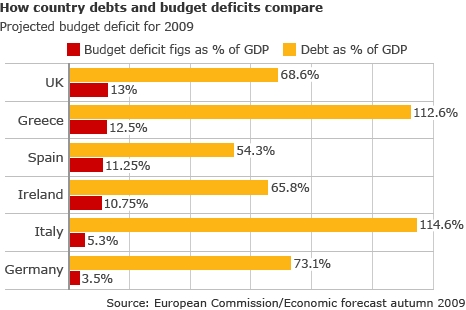

These seem pretty normal and fair compared to the rest of the world. Greece, historically has a very high population rate that does not pay taxes. So with the tax collections down 24% this past year it is no wonder they have been in trouble. In fact the true picture of Europe does not look pretty:

Most of these countries do not have the ability to print money like the USA. They have to abide by the rules of the European Union. The USA just prints it when needed. I had to include a youtube video to show you proof. What you will see, a quick nod and no rebuttal from Bernanke as Rep. Paul breaks down the current situation. There are a couple of key points in this video:

- The creation of $1.3 Trillion to buy securities came out of thin air

- The Fed buying these mortgages from the banks that then pushed $1.3 Trillion into the banking in essence giving these banks a free ride.

- The USA has increased IMF loan from $10B to 100 Billion

- The notion that if the money that the IMF bailout money is lost, then we take our share on that lose.

I don’t know about you, but all four of these points sound pretty lousy if you are on the hook for the any of the losses. Guess what…..we are! The taxpayer is ultimately responsible for the money loaned out. That IMF loan that goes to everyone else who needs money because they lived beyond their means, we as a country are responsible for. It is a sad state of affairs when this is what it has come down to. The truly sad part is that there is no end in site. Our current administration and Congress have increased the annual federal deficit by over times for each of the past two years when compared with Bush. The problem with that is that Bush’s spending was out of control at the time as well.

There is no sign of it ending. Our Congress is trying to push financial reform. We had a good system before they repealed the Glass-Steagall Act. Re-install it to take away the free ride of these too big to fail banks. There was a reason that the commercial and investment banks were separated. Th Glass-Steagall act also brought about the FDIC which for all intensive purposes is broke. They have made banks pay in 3 years in advance to cover potential loses and closings over the next year. There are 64 bank closings this year which is almost half of what we had last year.

As for the market in the short term, I hope everyone bought volatility in when it was back in the 16s on the VIX. There is a reason to own it when you can not when you need to.  We have seen spikes over $23 last week. Depending on the month that own a quick pop in volatility probably made your portfolio look better if you were long volatility.  I have been surprised as the volatility in the daily moves have increased. It seems the bulls are pushing a little harder then normal probably the shorts being forced to cover.

Buffet’s comments are well timed. I would be saying something positive as well, if I lent Goldman $10 Billion. Did he disclose that fact?

If the Euro and IMF loans are settling the jitters on Greece and other nations, then the Dollar will probably get hit as the Euro rallies. This will most likely cause oil to drop in price as well. The oil spill in the Gulf is still causing some slight supply issues, but nothing major that would cause a lack of inventory spike.

Look for further short squeezing from the markets as long as the Euro/IMF combo have their part of the world under control.

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy