Housing Shadow Inventory

admin on 05 1, 2010

What is the Housing Shadow Inventory and How Big is it?

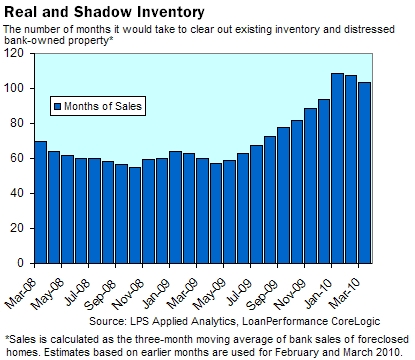

Housing inventory is the amount of houses that are for sale on the market. A number that is often used to calculate the real estate market is the months to unload that inventory at the current pace that homes are selling. The shadow housing inventory is the the homes that have been foreclosed on by banks and institutions. At this point banks need to keep some of the homes off of the market for fear of having too much supply. From simple economics we know that too much supply allows the price to drop. Sellers want to get out and are willing to lower their price. If their is too much supply then homes could continue to drop in price. How much inventory is on the market?

We found one article from the Wall Street Journal :

“As of March, banks had an inventory of about 1.1 million foreclosed homes, up 20% from a year earlier, according to estimates from LPS Applied Analytics. Another 4.8 million mortgage holders were at least 60 days behind on their payments or in the foreclosure process, meaning their homes were well on their way to the inventory pile. That “shadow inventory†was up 30% from a year earlier.

Based on the rate at which banks have been selling those foreclosed homes over the past few months, all that inventory, real and shadow, would take 103 months to unload. That’s nearly nine years. Of course, banks could pick up the pace of sales, but the added supply of distressed homes would weigh heavily on prices — and thus boost their losses.”

103 months is nine years of inventory at the current pace. There are people that are saying that this number is low.

- The Loan modification programs will have a failure rate of at least 75%. That is due to the Debt Ratios that the modifications are approved at. In February, the mean ratio was 59.8%. In March, it was 62.7%. To increase that much, most March approvals for the Debt Ratios had much higher than the 62.7 number.

- FHA, Fannie and Freddie are 95% of all new loans and purchases. Debt Ratios on these loans are up to 50%. FHA is considered the new subprime, and these loans are already beginning to default.

- 50% Debt Ratios were what subprime used, and we saw those default rates already.

- There is no indication of how many strategic defaults will occur over the next 2-3 years.

After adding in these additional factors, it is pretty scary that the shadow inventory will be much higher and it will take many more months for the banks to unload them all.

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy