Gold and Silver Potential

admin on 04 30, 2010

Yesterday I saw that Silver had a nice positive move taking out short term resistance of $18.61 on the Silver Future to settle at $18.491.  This morning it reached $$18.795. Our next resistance point $18.927 is from the January high consolidation. I have been warning you for months of the potential of the short squeeze and how the gold and silver markets are highly manipulated. I have written several articles on how the CFTC has allowed 4 major banks to be short the silver market to the tune of 10 times the annual production. Normally, a short is borrowed from someone who owns the asset. Naked short is without any asset earmarked at all. The gold and silver market shorts are selling imaginary ounces betting the price of silver will go down. Central banks have played a key role in trying to keep these prices down. A global investor has to think of the reasons that a central bank would want the price of gold and silver under control.

In order to truly discuss the reasons we need to go into some basics on currencies. We know that every currency through our entire world history that is not directly tied to gold has failed. You may have heard the term fiat currency. The more Dollars that get created out of thing air and pushed into the market decreases the value of the remaining Dollars. This is inflationary that it takes more Dollars to buy the same goods. The cost of a cup of coffee 10 years ago is much cheaper than the cost today. Let alone 50 -100 years ago. The Dollar has lost over 92% of its value since the 1800s. Once the US went off of the Gold Standard it gave them free reign to produce whatever amount of money they wanted. Please keep in mind that no fiat currency has ever survived.

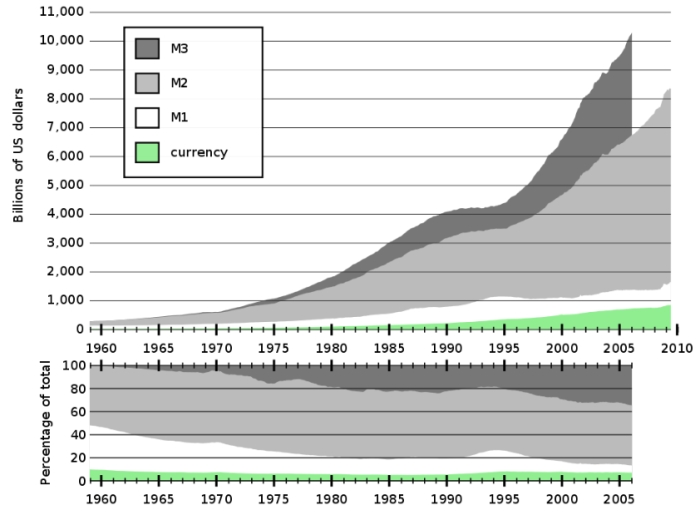

As you can see in the chart above, the money supply has grown exponentially. Our country has to finance this debt through loans. Just like the average household, we have creditors, people willing to loan us money. Except they are not people they are countries. The two largest countries are China and Japan. Two countries that both have fiat currencies as well.

These loans have interest rates that the countries want in return for lending us money. As we have seen in Greece over the past week, the investors are demanding higher and higher interest rates because they fear the risk that they will not get paid back is high. The US interest rate has remained relatively low even though our debt levels are high, not as high as Greece, but high.

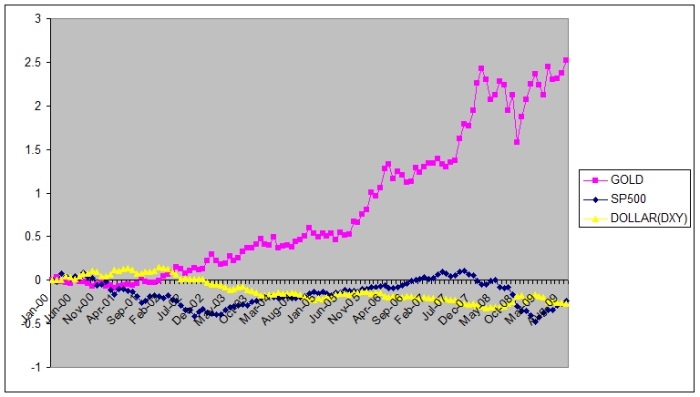

When investors start to fear that the increase in money supply will decrease the value of their money, they flock to something that will hold its value…gold. When money supply increases, this causes inflationary pressure and the countries that finance our debt want a higher interest rates in return. They are getting paid back with inflated dollars(less value). If the risk of the US defaulting increases, like Greece, then they will want a higher interest rate as well.

Through history the price of goods have remained stable in price only when compared to a gold. Gold has increased and decreased in price but it has also been very manipulated. The manipulation in gold and the increased demand is starting to create a buzz to own the actual. This means that you actually have the gold in your possession. There are plenty of stories about when an investor chooses to take delivery it is misplaced. There is a reason that China and India have recently(within the past 6 months) made huge purchases of the actual and demanded delivery.

So why have the central banks wanted to keep the lid on Gold and Silver? If the price of Gold and Silver increase it is because investors are looking for a safe asset to protect against inflation. If central banks are constantly telling you that there is no inflation as seen in their government statistics and gold is stable, will you believe them? If they push out the stats with no change and gold is consistently making new highs then maybe you will take a second look at their numbers. Maybe the flight to safety guys are seeing something that you have missed? Maybe interest rates are about to or already are spiking. If rates spike it is because of inflationary pressure. Inflationary pressure causes gold to increase. We have seen US rates at near zero for over a year and we know that these rates can not stay at zero forever. We have seen some short term spikes in the US Notes and Bonds of different durations.

If foreign investors start to demand higher interest rates to buy the ever increasing amount of the US debt through Notes and Bonds, then we will see several major problems that stem from higher interest rates. The mortgage and housing market will collapse even further. Spikes in mortgage rates could cause less homes to be purchased and higher foreclosure rates because of the amount of adjustable mortgages that would be reset to a higher interest rate. Higher rates means it costs more to fund out debt. Our national debt will be out of control and the most logical result for the 50% of the US population that actually pay taxes will be higher taxes.

Every investor should be concerned about the future of our country. There is a reason that the M3, a money supply statistic is no longer calculated by our government. There are only so many tricks in statistics before the truth reveals itself. That chart shows the current path of our money supplies and it is not predicted to decrease any time soon. What happens to our country when the money supply stops increasing? Are we at a point in our country that we need to keep the money supply increasing just to offset the destruction of wealth from the bubbles that the money supply has created.

Never before has the world economies been so tightly entangled. In the 1950’s we did not invest in communist China. Now we are dependent on them to buy our debt. They have their own debt problems along with Japan. How long can the charade keep going?

Central banks need to keep gold down so it does not become a mania. For the most part the average investor is blind to the economy. Head in the sand as they go through life. Job, marriage, kids, basic nightly nightly news of local dramas, a house with mortgage and credit card debt. They pay their taxes like a good little soldier. They read the local paper and never grasp what it truly going in the rest of the world or our economy. All mainstream media is bought and paid for so our average Joe never gets the real picture. That is why the majority of people lose their shirts in these bubbles.

They are taught to invest for the long term, but when a market goes from 14,000 to 6,400 back to 11,000 they should look at as a gift from the stock market gods. They must realize that the market can not and will not go straight back to the top even though that is what the big institutions, central banks, and governments are asking. They want everyone to buy in again so they can unload to someone.

I encourage everyone to protect themselves by protecting your portfolio. That means understand your risk in everything you own. Buy some gold and silver for the long term. Right now the price is manipulated. JP Morgan is short 80% of the total short silver market. Rumor is they are acting as a proxy for a central bank. If the central bank can produce money at will, then they don’t care how much they lose. A spike in silver or gold will have the world looking at inflation in a whole new light. It will spark more metal buying and interest rates will jump causing higher costs for anyone who has debts. This will put a global halt to any recovery.

There is huge potential if the central banks can’t stop the buying or any major fund demands the actual delivery. It is important to have some actual on hand. When the curtain falls and the system fails, you want to make sure you still own something of value. Stocks are just pieces of paper or IOUs do not pay the bills. When you go to sell them they could be worth half the price you paid for them.

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy