Week Ahead 6-14-2010

admin on 06 14, 2010

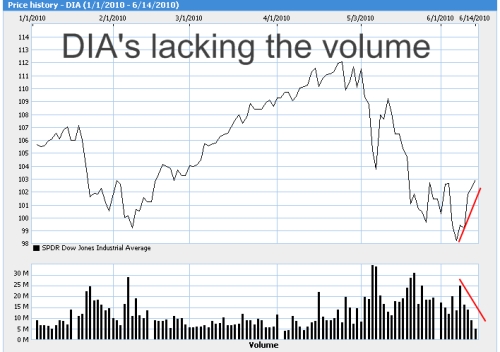

The markets have made a great run as predicted in last week’s article. The problem is that there was really no supporting news or basis for the market to do what it has done. In fact, the market went up despite a lot of bad news. The volume picture describes our thoughts here. Any sustainable rally needs volume to continue to buy through the resistance areas. If you approach resistance and no volume, then the rally will most likely fail. Our rally in the broad market has been more of a short squeeze vs sustainable rally.

RETAIL SALES / SENTIMENT

Retail Sales decreased in May by 1.2%. One would think that sales would be up since we added so many jobs last month. This drop in sales did not dash the hopes in the Retail Holder on Friday. In fact the RTH was up roughly $0.60 from open to close, but down slightly from the previous day. The talking heads keep pushing this concept that we can have a sustainable rally without the jobs coming back. It was only a few months ago that they used the retail sales figures as proof that all was good in the world. It is quite simple to put the pieces of the puzzle together. If the jobs do not come back, then housing and consumer spending is not going to increase. If fact, they will get worse. The longer it takes for real sustainable longer term jobs to come back, the worse our depression will become. The higher the foreclosure rate will have to go, even though banks are doing everything they can to keep people in their homes. Most will probably let them live there for free, at least they will keep the place clean until the market comes back.

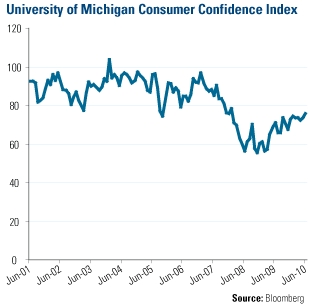

Michigan’s Consumer Sentiment was up slightly last week, which the talking heads used to offset the retail sales. Gallop has done their own confidence index which showed the opposite results as the CSI.

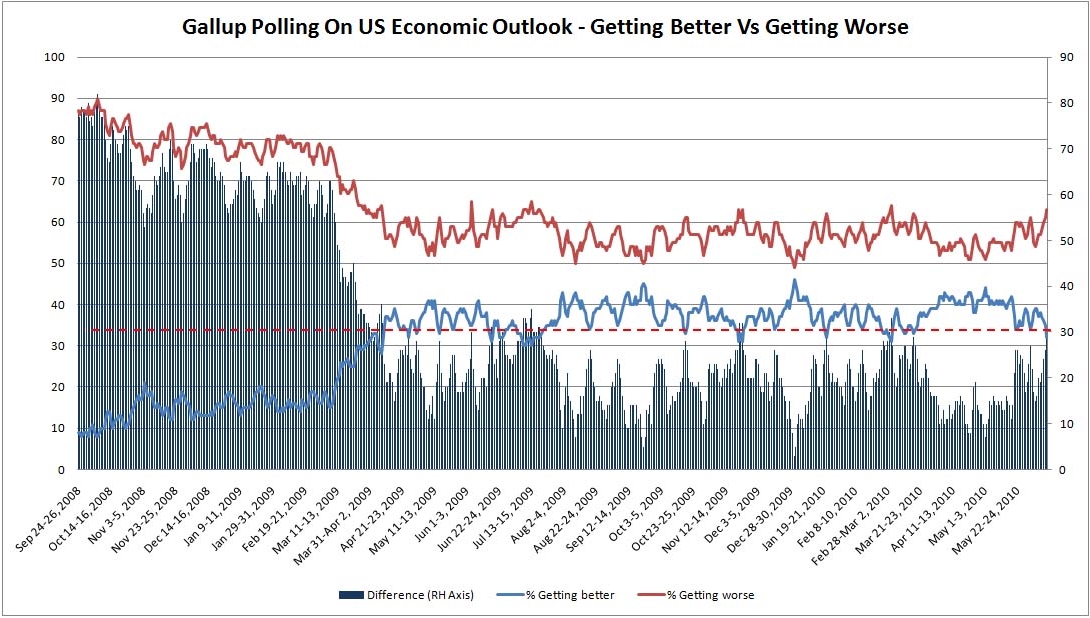

The Gallup ECI below timed the upswing in the market pretty well. It has has had a pretty consolidated range even though the market has improved since the march 2009 bottom.

The differential below is very intriguing as well. The percentage of people that think the economy is getting better vs worse.  When the market was tanking this differential was very high. We are now up against resistance around the 30 line. This is another negative sentiment vs the Michigan CSI.

Just how the stock market needs volume to support the move, our economy needs jobs. Without volume or jobs, the market/economy can go sideways, but it is on borrowed time. Housing will continue its slump and as long as the jobs don’t come back, it will continue to get worse.

FANNIE MAE & FREDDIE MAC

“The Congressional Budget Office calculated in August 2009 that the companies would need $389 billion in federal subsidies through 2019, based on assumptions about delinquency rates of loans in their securities pools. The White House’s Office of Management and Budget estimated in February that aid could total as little as $160 billion if the economy strengthens.” Some estimates go as high as 1 Trillion to fix these to companies. The thing that is not talked about is how the Fed/Treasury will shift their purchase of the $1.25 Trillion of MBS purchases to Fannie and Freddie. If this happens then we will most likely see Billions of Dollars in losses for many years to come.

OIL /BP

More problems for British Petroleum (BP). They are getting backlash for several small things, like their $50million advertising budget to try to save face around the world. More pressure is coming to cut their dividends to save money to pay for this mess. There are also fears of BP layoffs from some of their plants in the US.

The biggest fear is that why some are worrying about closing off the well that is pouring more oil than we think it is, there are some that are worried about the complete deep water structure. There is growing evidence that the “Well Bore” has suffered significant damage under the sea floor. Some are worried that this could potentially go on for years. The potential damage reaching over $1Trillion. Once it gets around the pan handle and up the East Coast and down to the Caribbean then the current estimates of around $200Billion will be blown exponentially increased. BP will have no choice but to declare bankruptcy, they simply do not have the cash on hand. I am amazed it is still trading above $30.

Keep a close eye on volume over the next day or two. If the market can hold in here around unchanged, then market buyers may start to step in with the next hyped up story. If reality sets in though, look for retest of the lows from last week. If that is broken, then you seriously need to make sure you have protection. If you haven’t seen it yet, watch the webinar I did on protecting your portfolio through Beta weighting. I also gave the spreadsheet from that webinar away for free.

Have a great week!

Ryan

Popular Posts

Recent Posts

Recent Comments

- CheapIV.com » Why You can Throw Traditional Diversification in the Trash: ... have spent their

- Tim Geithner – China’s Laughing Boy - Trade the E-minis: ... Learn how Timmy

- Tim Geithner – China’s Laughing Boy | Notes from the E-mini Trading Professor: ... Learn how Timmy

- Swing Trading Stock: ... Learn Timmy Next

- Timmy Geithner has Cried “Wolf” Too Many Times | THE ART OF EXCESS: ... Learn how Timmy